Top Guidelines Of Matthew J. Previte Cpa Pc

Top Guidelines Of Matthew J. Previte Cpa Pc

Blog Article

Things about Matthew J. Previte Cpa Pc

Table of ContentsThe 30-Second Trick For Matthew J. Previte Cpa PcThe Of Matthew J. Previte Cpa PcThe Definitive Guide for Matthew J. Previte Cpa PcMatthew J. Previte Cpa Pc Fundamentals ExplainedGetting My Matthew J. Previte Cpa Pc To WorkThe smart Trick of Matthew J. Previte Cpa Pc That Nobody is Talking About

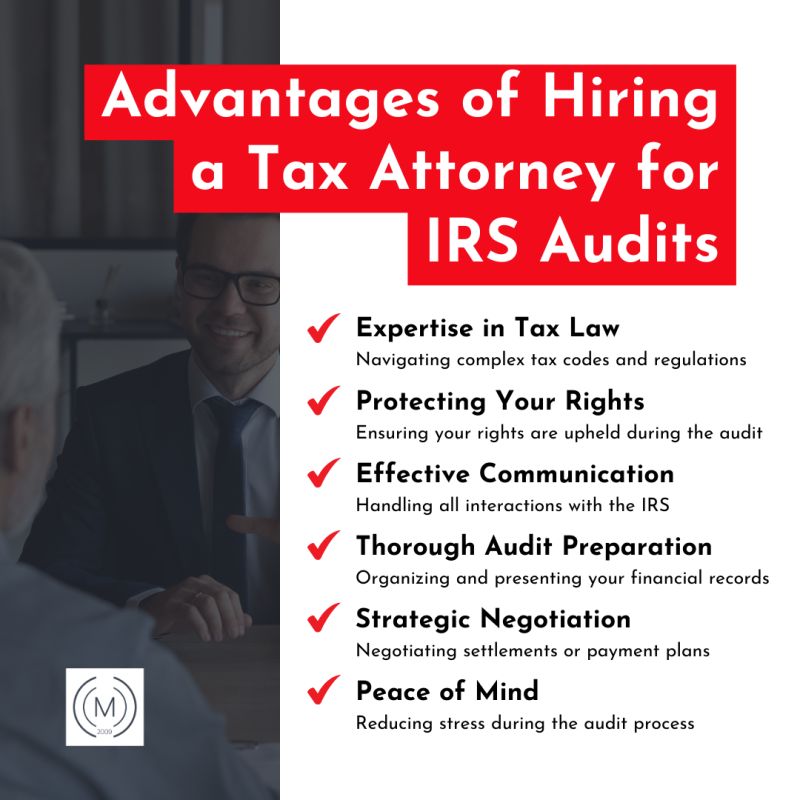

Also in the easiest economic circumstance, submitting state and/or federal taxes can be a daunting yearly job. When it pertains to browsing intricate tax concerns, though, this confusing process can be downright daunting to deal with on your own. No matter of your income, reductions, house demographics, or occupation, functioning with a tax lawyer can be valuable.Plus, a tax attorney can talk to the Internal revenue service on your part, saving you time, energy, and frustration. A tax obligation attorney is a kind of attorney who specializes in tax obligation regulations and treatments.

Matthew J. Previte Cpa Pc Things To Know Before You Buy

If you can not satisfy that debt in time, you might also encounter criminal charges. For this factor, superior tax financial debt is a terrific factor to employ a tax relief lawyer.

A tax obligation lawyer can additionally represent you if you pick to battle the internal revenue service or aid produce a technique for settling or working out the deficit. The method you structure and handle your businessfrom beginning to everyday operationscan have remarkable tax ramifications. And the wrong choices can be pricey. A tax obligation attorney can provide guidance, help you identify exactly how much your service can anticipate to pay in taxes, and recommend you of techniques for reducing your tax burden, which can aid you avoid costly blunders and unanticipated tax obligation costs while capitalizing on particular guidelines and tax rules.

Picking a tax attorney ought to be done meticulously. Here are some methods to boost your opportunities of finding the best individual for the work: Prior to working with a tax obligation attorney, knowing what you require that lawyer to do is very important. Are you seeking to lower your tiny business's tax concern annually or establish a tax-advantaged estate strategy for your family members? Or do you owe a considerable financial obligation to the internal revenue service however can not pay? You'll desire a tax obligation attorney who specializes in your particular field of demand.

What Does Matthew J. Previte Cpa Pc Do?

Some tax obligation alleviation companies offer bundles that give tax obligation solutions at a flat price. Various other tax lawyers may bill by the hour.

With tax obligation lawyers who bill hourly, you can anticipate to pay in between $200 and $400 per hour on average - https://www.bitchute.com/channel/tOLy7GNhu4qP/. Your final expense will be figured out by the intricacy of your situation, exactly how quickly it is minimized, and whether ongoing services are required. A fundamental tax audit might run you around $2,000 on standard, while finishing an Offer in Concession may cost closer to $6,500.

9 Easy Facts About Matthew J. Previte Cpa Pc Explained

The majority of the time, taxpayers can take care of personal revenue taxes without way too much difficulty but there are times when a tax obligation lawyer can be either a handy resource or a required companion. Both the internal revenue service and the California Franchise Tax Board (FTB) can obtain rather hostile when the guidelines are not followed, even when taxpayers are doing their ideal.

Both federal government companies provide the revenue tax code; the internal revenue service manages federal tax obligations and the Franchise business Tax obligation Board handles California state taxes. IRS Seizures in Framingham, Massachusetts. Since it has less resources, the FTB will piggyback off results of an internal revenue service audit yet emphasis on locations where the margin of taxpayer mistake is higher: Purchases consisting of funding gains and losses 1031 exchanges Beyond that, the FTB has a propensity to be extra hostile in its collection strategies

The Greatest Guide To Matthew J. Previte Cpa Pc

Your tax attorney can not be asked to indicate against you in legal process. A tax attorney has the experience to accomplish a tax obligation settlement, not something the person on the road does every day.

A CPA might be acquainted with a few programs and, even after that, will not necessarily recognize all the provisions of each program. Tax code and tax obligation regulations are complex and often transform yearly. If you remain in the internal revenue service or FTB collections procedure, the wrong guidance can cost you very much.

The Only Guide to Matthew J. Previte Cpa Pc

A tax obligation lawyer can likewise assist you discover methods to lower your tax bill in the future. If you owe over $100,000 to the internal revenue service, your instance can be placed in the Big Dollar System for collection. This unit has one of the most knowledgeable agents helping it; they are hostile and they close instances quickly.

If you have potential criminal concerns entering the examination, you most definitely desire a legal representative. The internal revenue service is not understood for being overly responsive to taxpayers useful content unless those taxpayers have cash to turn over. If the internal revenue service or FTB are overlooking your letters, a tax obligation attorney can compose a letter that will certainly obtain their interest.

Report this page